PNP to receive Performance Based Bonus (PBB) 2024

Qualified government employees, including police cops, may go home with a smile as they would be receiving their year-end bonus and cash gift amounting to 5,000 pesos on November 15.

The year-end bonus is

equivalent to personnel’s one month salary. It is given to government workers

who have rendered at least four months of service from January to October 31 of

the current year and those working in the government service as of October 31

of the same year.

Those

who have worked for at least four months but have retired or separated from

government service before October 31 of the same year shall be granted within

the month of retirement or separation, a prorated share of the year-end bonus

and cash gift.

Meanwhile,

13th-month pay and other benefits, including productivity incentives that are

less than P90,000, are tax-exempted per Tax Reform for Acceleration and

Inclusion (TRAIN) Law.

The year-end bonus will be credited to the individual ATM payroll accounts of PNP personnel with the Land Bank of the Philippines, and is available for debit transactions.

However, the release of bonus to PNP personnel with pending administrative and criminal cases was deferred.

Former President Rodrigo Roa Duterte has doubled the salary of police officers across all ranks as he ordered an intensified crackdown on illegal drugs and criminality.

With the monthly base pay implemented January last

year, a Patrolman (Pat/PO1) is receiving P29,668, while the PNP chief, who is

ranked Police General (PGEN), is getting P121,143.

Performance Based Bonus (PBB) FY 2023

It

is a bonus presented via the Performance-Based Incentive System (PBIS), will be

given to government employees based on their contribution to the accomplishment

of their Department’s overall targets and commitments.

Under

the PBB, units of Departments will be ranked according to their performance.

The personnel within these units shall also be ranked. The ranking of units and

personnel will be based on their actual performance at the end of the year, as

measured by verifiable, observable, credible, and sustainable indicators of

performance.

How much will the PBB be?

The

amount will depend on the performance of each employee and the unit that he/she

belongs to. This is to foster a culture of teamwork within each unit and within

the department itself, especially if the latter has different kinds of outputs

and services to deliver.

The Best Performer from the best-performing unit or “Best Bureau” will get a PBB of 65% of Base Pay; the Better Performer from a “Better Bureau” will get 57.5% of Base pay; while the Good Performer from a “Good Bureau” will get 50% of Base pay. However, the minority of poor performers will get no PBB.

GUIDELINES IN THE PAYMENT OF PERFORMANCE BASED-BONUS (PBB) CY 2023

Under IATF-MC No. 2022-1 entitled Guidelines on the Grant of the Performance-Based Bonus (PBB) Fiscal Year (FY) 2022, the following are the criteria in granting PBB:

1. This eligibility of the PNP to the 2023 PBB shall be determined by the Inter-Agency Task Force (IATF).

2. Specific Guidelines:

The total score of the PNP is the basis in determining the amount of the PBB. Based on the validation of the IATF, the PNP has obtained 80 points for the PBB Criteria and Conditions. It is equivalent to 52% (80% of an individual’s 65% monthly basic salary as of December 31, 2023)

3. Eligibility of Delivery Units and PNP personnel:

a. The delivery units (DUS) of eligible agencies shall no longer be ranked. However, the unit/s most responsible for deficiencies shall be isolated;

b. The offices/units responsible (including the head) for the non-compliance with the Agency Accountabilities will also be isolated from the grant of the FY 2023 PBB;

c. Eligible DUs shall be granted FY 2023 PBB at uniform rates across the PNP, including officials and employees. The corresponding rates of the PBB shall be based on the PNP’s achieved total score;

d. Personnel belonging to the First, Second and Third levels should receive a rating of at least “Very Satisfactory” based on the PNP’s CSC-approved Strategic Performance Management System (SPMS) or the requirement prescribed by the Career Executive Board (CESB);

e.

Personnel on detail to another government agency for six (6) months or more

shall be included in the recipient agency that rated his/her performance. The

payment shall come from the mother agency;

f.

Personnel who transferred from one government agency to another agency shall be

included by the agency where he/she served the longest. If equal months were

served for each agency, he/she will be included in the recipient agency;

g. Personnel who transferred from one government agencies that are

non-participating in the implementation of the PBB, shall be rated by the

agency where he/she served the longest; the personnel shall be eligible for the

grant of PBB on the pro-rata basis corresponding to the actual length of

service to the participating implementing agency;

h. PNP

personnel who rendered a minimum of nine months of service during the fiscal

year and with at least a Very Satisfactory rating shall be eligible for

the grant of the PBB on a pro-rata basis corresponding to the actual length of

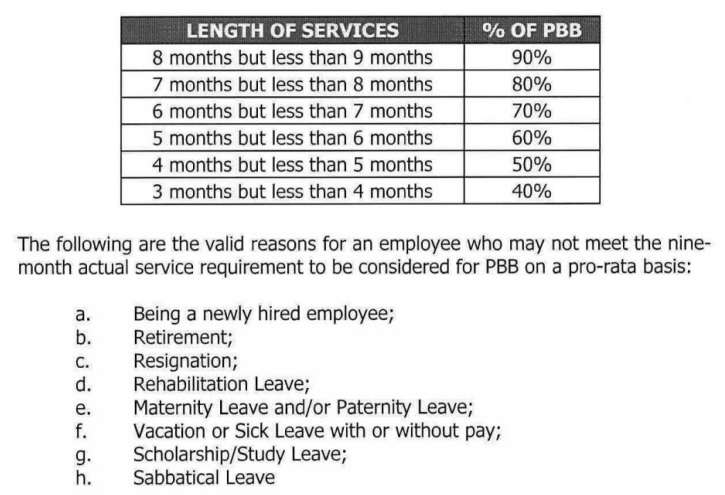

service rendered as follows;

i. PNP personnel who is on vacation or sick leave, with or without pay for the entire year, is not eligible for the grant of the PBB;

j. PNP personnel found guilty of administrative and/or criminal cases by final and executory judgement in FY 2023, shall not be entitled to PBB. If the penalty meted out is only reprimand, such penalty shall not cause the disqualification of the PBB;

k. PNP personnel who failed to submit the 2022 SALN as prescribed in the rules provided under the CSC Memorandum Circular No. 3 s.2015 or those who are responsible for the non-compliance with the establishment and conduct of the review and compliance procedure of SAN, shall no entitled to the FY 2023 PBB; and

l. PNP personnel who failed to liquidate all cash advances received in FY 2023 within the reglementary period as prescribed in COA Circular 97-002 dated February 10, 1997 and reiterated in COA Circular 2009-002 dated May 18, 2009 shall not be entitled to the FY 2023 PBB.

Date of payment of PBB 2023?

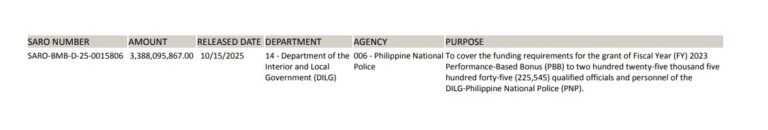

UPDATE!!! (As of October 21, 2025)

On October 15, 2025, the Department of Budget and Management (DBM) approved a budget of ₱3,388,095,867 for 225,545 qualified Philippine National Police (PNP) personnel to facilitate the grant of the FY 2023 Performance Based Bonus (PBB2022).

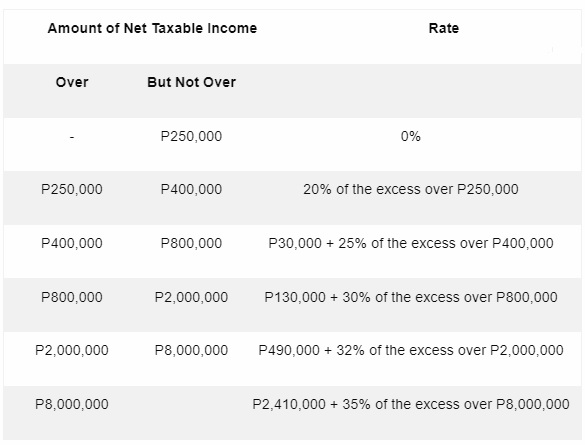

According to DBM Circular 2019-1 and other pertinent orders, the release of PBB 2023 to individual PNP personnel is subject to an 8% tax.

The uniformed personnel are also enjoying allowances such as longevity

pay, flying pay, sea duty pay, and instructor’s duty pay.

Can Retired/Separated PNP personnel claim the PBB 2023?

YES! The PNP Finance Service issued a Memorandum dated June 18, 2024 granting eligible PNP personnel to include RETIRED/SEPATED from the PNP Service of Performance Based Bonus 2022.

Generally,

the payroll account of the retired/separated personnel were already closed. These

personnel, however, are still eligible for bonuses.

PNP

Finance shall process the transfer of amount from their payroll account to

their pension or regular accounts with Landbank of the Philippines (LBP).

Below

are the documentary requirements to be submitted to PNP Finance for processing:

a. For

COMPLUSORY/OPTIONAL RETIREMENT

1. Retirement

Order;

2. STI1 (pension/account); and

3. STI1 payroll account if account is active (secured after PBB payout) or Certification from LBP that the account is closed.

b. For

POSTHUMOUS SEPARATED/POSTHUMOUS RETIREMENT

1. Posthumous

Order;

2.

Certificate of Last Payment;

3. Certificate

of Legal Beneficiary (issued by PRBS)

4. STI1 (beneficiaries’ pension/saving account); and

5. STI1 payroll account if account is active (secured after PBB payout) or Certification from LBP that the account is closed.

c. Other MODES OF SEPARATION

(TPPD, RESIGNED, TRANSFERRED, DISMISSED, DROPPED FROM ROLLS)

1. Order;

2. Certificate

of Last Payment

3. STI1 (regular/savings); and

4. STI1 payroll account if account is active (secured after PBB payout) or Certification from LBP that the account is closed.