PNP Provident Fund Loan

PNP Provident Fund Loan

What is PNP Provident

Fund?

PNP Provident Fund (PNPPF)

It is being administered by the PNP to provide the granting of benefits and loans at very minimal interest rate to PNP members for their emergency needs, for their education or that of their children; for their hospitalization or that of their immediate dependents; for minor but immediately needed repair of their houses, and for other similar purposes to be determined by its Board of Trustees.

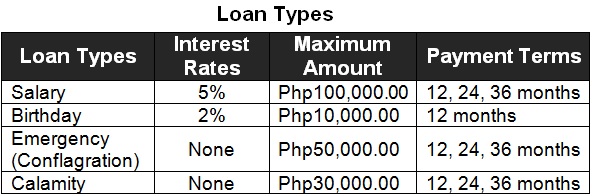

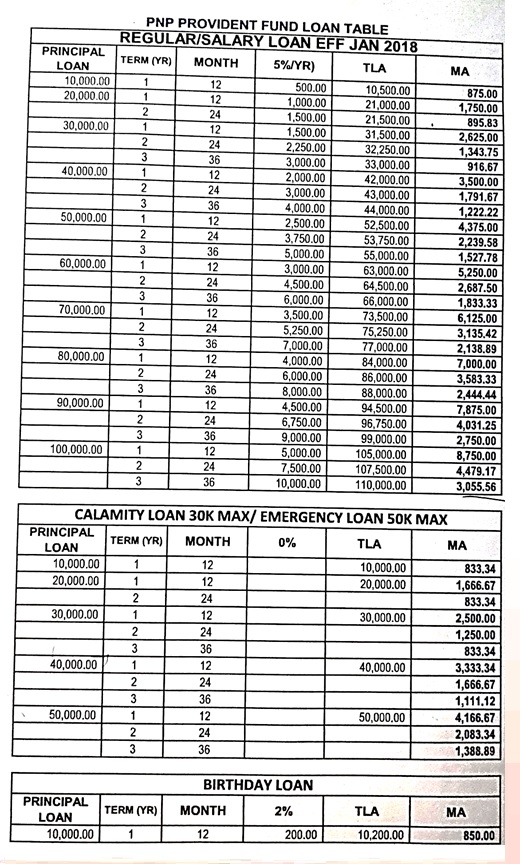

Salary Loan

Salary

loan is granted to members for the following purposes:

a.Education;

b.Hospitalization;

c.Minor repair of houses; and

d.Other similar purposes.

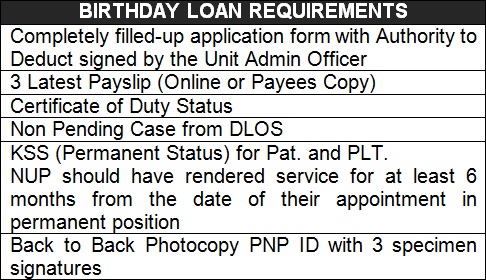

Birthday Loan

The PNP Provident Fund Board of Trustees has approved on May 7, 2015 the proposed “Birthday Loan” for all PNP Personnel (Uniformed and Non-Uniformed Personnel) in accordance with Section 4.d of the AO 279. The “Birthday Loan” is deemed a benefit for it has a minimal interest rate of 2% as compared to other lending entities. The loanable amount is Php10,000.00 payable for 12 months with a monthly amortization of Php850.00.

Qualifications of Borrower:

-He/She

shall not be retiring within 12 months;

-He/She shall be on active duty status and has no pending case;

-Appointment must be on Permanent Status. NUP must have rendered 12 months service after effective date of appointment.

Note: Birthday Loan may be granted over and above an existing salary, calamity or emergency loan, provided that the monthly deduction will not reduce the Net Take Home Pay (NTHP) below minimum prescribed amount as follows:

-Uniformed Personnel- Php3,000.00

+Subsistence Allowance

-Non-Uniformed Personnel-Php3,000.00

Borrower must file his/her application and supporting documents one (1) month prior to the date of birth at the Regional Finance Service Office. Application forms are available at the Regional Finance Service Office.

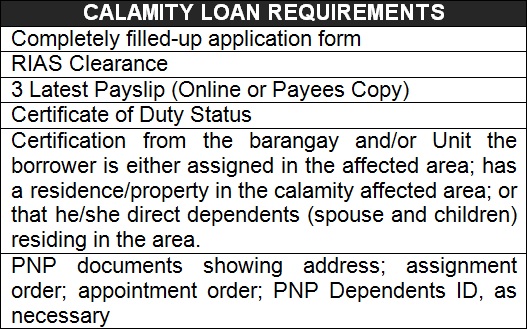

Calamity Loan

Calamity

loans shall be granted over and above existing salary loan under the following

circumstances provided that the monthly deduction will not reduce the required

monthly net take home pay of the borrower.

-The

area where the borrower is assigned or residing at is declared under state of

calamity; and

-Other circumstances

as determined by the Board of Trustees.

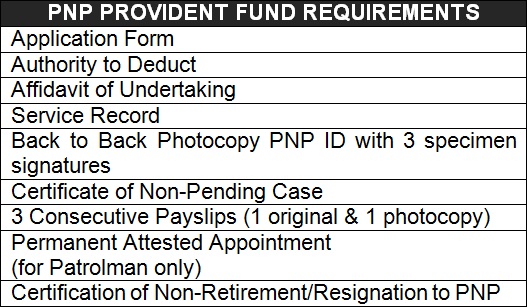

Initial Requirements for Provident Loan:

1. PNP ID

2. RIAS Clearance

3. Duty Status

Note: The PNP

Finance Service has implemented the online loan application, which can be

accessed through lsams.pnp.gov.ph,

but unfortunately, the said website is currently down.

General Appropriations Act (GAA) 2017, otherwise known as RA 10924, authorized deductions from salaries as payment for contributions or obligations shall in no case reduce the employee’s monthly net take home pay to an amount lower than Four Thousand Pesos (P4,000.00). This provision of the law on the minimum NTHP may vary annually. It is being applied to all government and financial institutions.

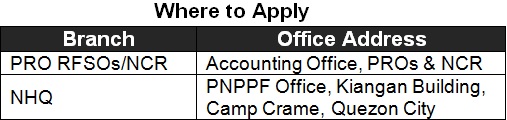

For more inquiries, visit your respective Regional Finance Service Offices (RFSOs).

Source/s:

PNP RFSO

pnppf.org