No Loan Deduction in the next few months?

No Loan Deduction in 2022?

Extending the Period of a State of Calamity throughout of the Philippines until September 12, 2022

President Rodrigo Roa Duterte has signed Proclamation No. 1218 on September 10 which extend the declared State of Calamity throughout the Philippines for one (1) year effective September 13, 2021 to September 13, 2022. Is there possible no loan deduction for the next few months?

When will be the effectivity of

Bayanihan 2?

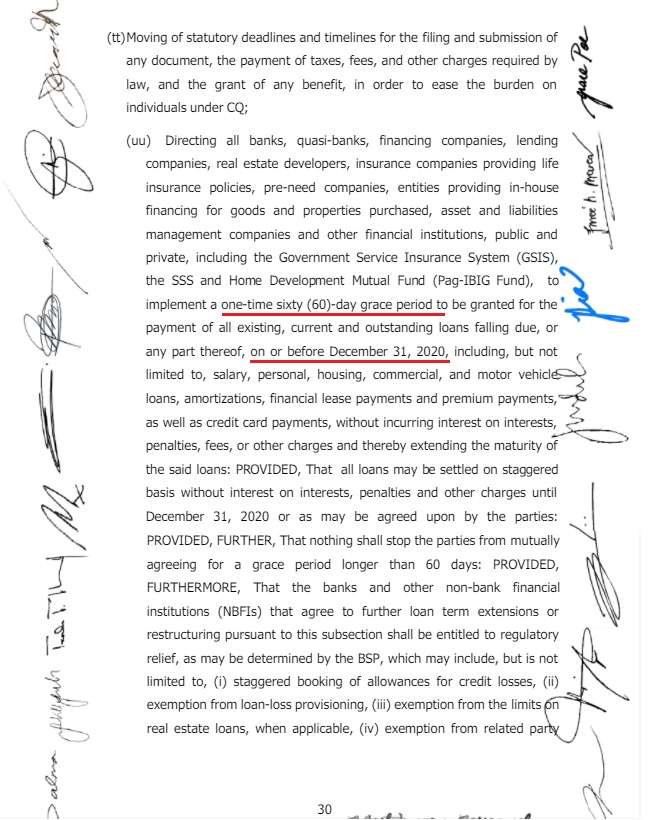

According to Benjamin Diokno, Governor of Bangko Sentral, the effectivity of Bayanihan 2 will be 15 days after the President signs the law following the publication in the Official Gazette or in a newspaper of general circulation. The effectivity of the Bayanihan 2 will be on September 26.

Since government payslips are generated or issued every month and November payslip has been released, then the possible no loan deduction would fall on December onwards.

“The implementing rules and

regulations (IRRs) will be released as soon as possible (if the President signs

it). In fact, ginawaga na nga naming during the weekend in anticipation of the

President signing this measure today. Once both houses ratify the bill and

elevated to the President for signature, then the IRRs will be ready.”

Diokno added.

Updates:

Updates for the first quater 2022 – TBA – Wait for the Announcement

09/18/2020 – Bangko Sentral ng Pilipinas (BSP) issued a Memorandum No.M-2020-068 directing all financial institutions to implement the RA 11494 or the Bayanihan 2.

09/18/2020 – AFPFC MPC Advisory – declaring temporary suspension on all loan deductions for the month of October and November 2020

09/17/2020 – PSSLAI posted through FB page informing clients to stay tuned for their annoucement.

09/11/2020 – Pres. Duterte has signed the Bayanihan 2 bill into law.

09/07/2020 –During the Palace press briefing, Presidential Spokesperson Harry Roque said: “I don’t think the first two weeks of September 2020 will pass without the bill being signed. I think they’re aiming that the bill should be signed this week–next week at the latest.”

Bayanihan to Heal as One Act (May 25-June 24, 2020)

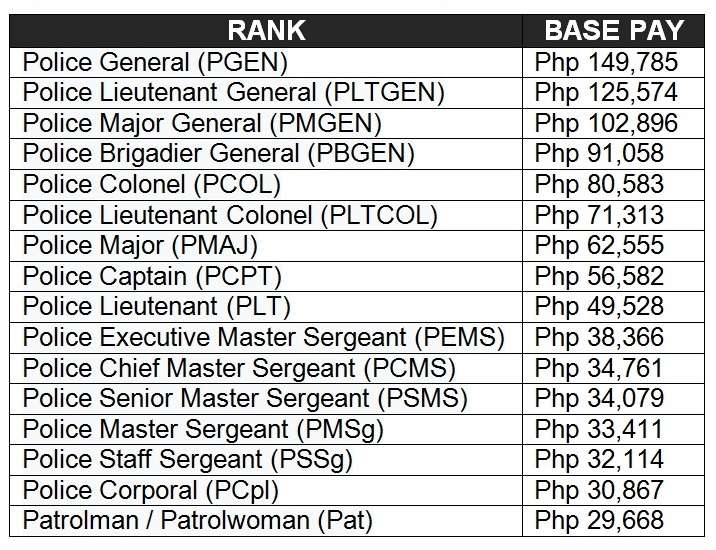

The PNP Finance Service implemented the thirty (60)-day moratorium on salary deductions last April & May 2020 representing monthly amortization for loans made by PNP personnel in six (6) accredited financial institutions that provide financial services to PNP members.

Upon instructions of the Former PNP Chief, PGEN Archie Francisco F Gamboa, thru the Directorate for Comptrollership, under PBGEN Marni Marcos Jr., made efforts in coordinating with the accredited private lending institutions with regard to the suspension of loan deductions in order to augment the financial capabilities of PNP personnel by increasing their take home pay which in turn shall benefit their respective families especially during the implementation of the Enhanced Community Quarantine in Luzon as a public health measure in response to the COVID-19 pandemic. (Ref: PNP)

PBGEN Marcos said “the 30-day reprieve will take effect in the April 2020 pay period and

will result in increased net take home pay to PNP Personnel with outstanding

loan balances in these financial institutions.”

He also instructed the PNP Finance Service to effect the changes in the April-May 2020 payroll of 205,000 active-duty PNP personnel.

These

financial institutions, namely:

1.

Armed Forces and Police Savings and Loan Association Inc. (AFPSLAI);

2.

Public Safety Savings and Loan Association INc. (PSSLAI);

3.

Air Materiel Wing Savings and Loan Association Inc (AMWSLAI);

4.

PNP Provident Fund;

5. Public Safety Mutual Benefit Fund Inc (PSMBFI); and

6. Armed Forces and Police Mutual Benefit Fund Inc (AFPMBAI).

All of these accredited financial institutions have implemented their respective 30-day suspension of monthly payment of loan accounts of PNP members without penalty as provided under Republic Act 11469 or Bayanihan to Heal as One Act.

However, monthly amortization will resume after the 60-day grace period.

Warning

against Fake News

PNP spokesperson PBGEN. Bernard Banac warned

the public to refrain from posting and sharing unverified information showing a

hazard pay computation of the PNP, AFP, and the BJMP.

“We

will go against those making fake news and unverified information as it would

tend to sow confusion among the public,” he added.