How to process PNP Retirement & Separation Benefits

PNP Retirement and Separation Benefits

Now

that you have reached the last day of your duty as a public servant, we would

like to thank you for your service to our country and for all the personal

sacrifices you have made while serving the nation. We know that your job

requires a lot of sacrifice and patience — patience in the sense that you have

to swallow your pride over arrogant civilians because your family and loved

ones are always waiting for your return.

If you have been serving for at least 20 years, then you can apply for an optional retirement.

Note:

Compulsory retirement age – 56 years old.

Optional retirement – must have served at least 20 years

In

this article, we’ll walk you through how to process and compute your retirement

claims.

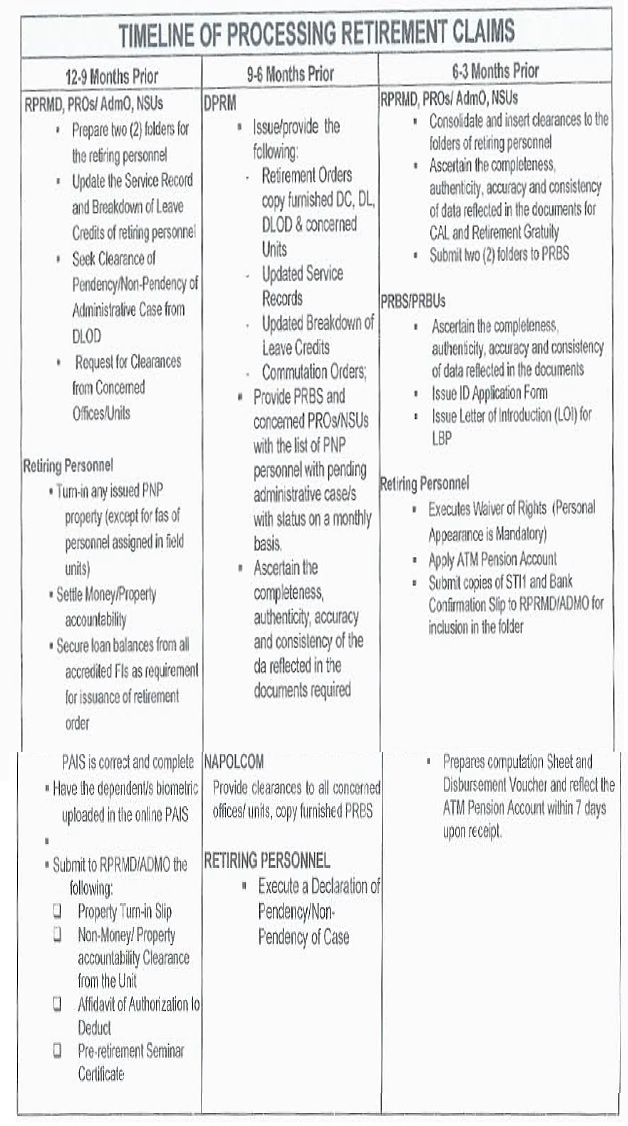

How to

process your PNP Retirement Claim

The

following tasks must be completed by retiring PNP personnel:

a. one

year before the retirement’s effective date.

a.1) Turn

in any PNP property/equipment and obtain a Non-Property Accountability

Clearance EXCEPT for those assigned to field units, where a provisional

clearance will be issued;

a.2) Check that the information in your online PAIS is CORRECT and COMPLETE; and

a.3) Have the biometric/s of dependent/s uploaded in the online PAIS.

b. Submit the following to RPRMDs/ARMDs upon receipt of a Retirement Order:

b.1) Affidavit of Authorization to Deduct allowing the PNP to deduct accountabilities from retirement benefits for those who have accountabilities.

b.2) Pre-retirement seminar certificate

b.3) File the ending SALN 30 days after retirement with your respective RPRMDs/ARMDs, who will then submit it to the RMD, DPRM, and PRBS. This SALN is different from that required in the claims folder which is the latest SALN submitted.

a.) Compulsory Retirement

It shall be upon attainment of age fifty-six (56) for officer and non-officer: Provided, That, in case of any officer with the rank of Chief Superintendent (Police Brigadier General), Director (Police General) Or Deputy Director General (Police Lieutenant General), the Commission may allow his retention in the service for an inextensible period of one (1) year.

b.)

Optional Retirement

Upon

accumulation of at least twenty (20) years of satisfactory active service, an

officer or non-officer, at his own request and with the approval of the

Commission, shall be retired from the service and entitled to receive benefits

provided by law (Ref: Sec 40 RA 6975).

c.)

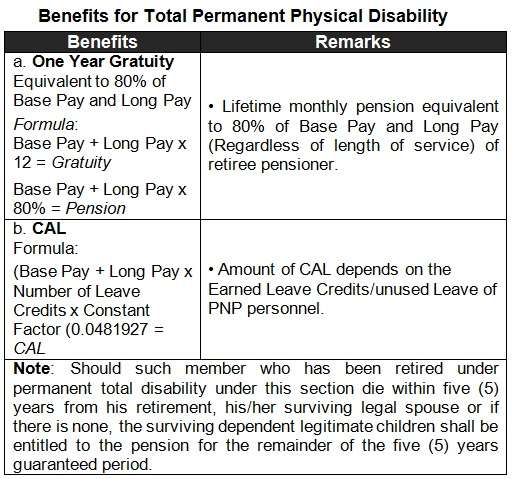

Total Permanent Physical Disability

(TPPD)

An

officer or non-officer who is permanently and totally disabled as a result of

injuries suffered or sickness contracted in the performance of his duty as duly

certified by National Police Commission, upon finding and certification by the

appropriate medical officer, that the extent of the disability or sickness renders

such member unfit or unable to further perform the duties of his position,

shall be entitled to one (1) year salary and lifetime pension equivalent to

eighty percent (80%) of his last salary, in addition to other benefits as

provided under existing laws

Should such member who has been retired under permanent total disability under this section die within five (5) years from his retirement, his/her surviving legal spouse of if there be none, the surviving dependent legitimate children shall be entitled to the pension for the remainder of the five (5) years guaranteed period.

d.)

Death and Disability Benefits

A

uniformed personnel and/or his heirs shall be entitled to all benefits relative

to the death or permanent incapacity of said personnel, as provided for under

this Act, and/or other existing laws. (Ref Section 76, RA 6975) “An officer or

non-officer with at least twenty (20) years of active service who dies in line

of duty shall be considered compulsory retired for survivorship benefits.

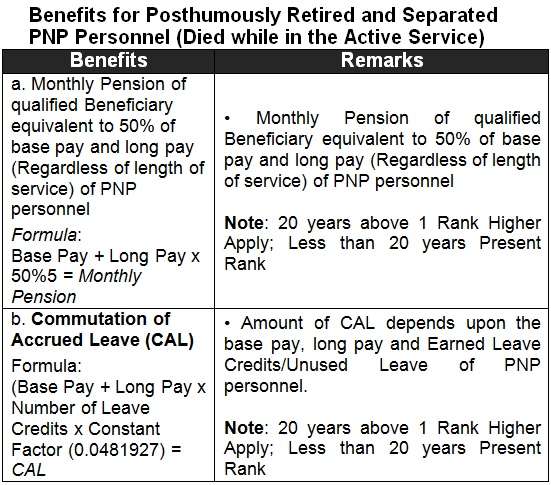

The Survivors of an officer or non-officer retired under this Section shall be entitled to a monthly annuity equivalent to 50% of Base Pay & Long Pay based on the grade next higher than the separation grade, to be divided equally among the survivors with the right for accretion.

NOTE: Applies to

posthumously retired PNP personnel died in line of duty with at least 20 yrs of

active service. “An officer or non-officer with less than twenty (20) years of

active service who dies in line of duty shall be considered separated for

survivorship benefits” (Ref: Section 10, NAPOLCOM BOR No. 8). “The Survivors of

an officer or non-officer separated under this Section 10 shall be entitled to

a monthly annuity equivalent to 50% of Base Pay & Long Pay based on his

separation grade, to be divided equally among the survivors”. (Ref: Section 15

of NAPOLCOM Board of Officers Resolution No. 8)

NOTE: Applies to

posthumously retired PNP personnel died in line of duty with less than 20 yrs

of active service.

Note: Qualified

beneficiary (Ref: Section 25 of NAPOLCOM Board of Officers Resolution No 8 as

amended by NAPOLCOM Resolution No. 2007-376)

Survivor/Transferee shall mean:

1)

Surviving spouse legally married to the deceased prior to the latter’s

retirement/ separation, not legally separated by judicial decree issued on

grounds not attributable to said spouse, and who have not abandoned the

deceased without justifiable cause: Provided, that entitlement to benefits

shall automatically terminate upon re-marriage of the surviving spouse;

2)

Surviving legitimate, legitimated, legally adopted children, including the

illegitimate children, who are unmarried not of majority age (18 years old) ,

or is over the age of majority but incapacitated and incapable of self-support

due to a mental or physical defect acquired prior to the age of majority. The

share of an illegitimate shall be equivalent to one-half (1/2) of a legitimate

child. Provided, that the entitlement to benefits shall terminate upon the

attainment by the capacitated children of the majority age or upon contracting

a marriage, whichever comes first; and

3) In default of those mentioned in paragraphs 1 and 2 above, the surviving parent or parents, or in default thereof, the surviving unmarried brothers and/or sisters not of majority age.

e.

Separation/Dropped from the

Rolls/Dismissed/ Resignation/ Attrition

1)

Separation

It

refers to the termination of employment and official relations of a PNP member

who rendered less than twenty (20) years of active service in the government

with payment of corresponding benefits (Ref: Section 37 of Civil Service

Commission)

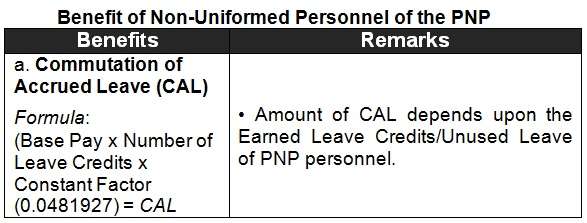

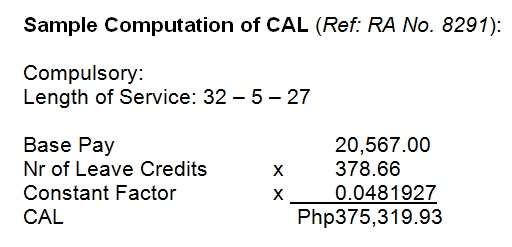

CAL= Base Pay + Long

Pay x Number of Leave Credits x Constant Factor (0.0481927)

2)

Dropped from the Rolls

It

refers to officers and employees who are either habitually absent or have

unsatisfactory or poor performance or have shown to be physically and mentally

unfit to perform their duties (Ref: Revised Omnibus Rules on Appointments and Other

personnel Actions – Dec 2009)

CAL= Base Pay + Long Pay x Number of Leave Credits x Constant Factor (0.0481927)

3)

Dismissed

It

refers to separation of the personnel in the police service as a result of his

case, shall carry it that cancellation of eligibility, forfeiture of retirement

benefits, and the disqualification in the re-employment in the government

service (Ref: Revised Omnibus Rules on Appointments and Other personnel Actions

– Dec 2009).

CAL= Base Pay + Long

Pay x Number of Leave Credits x Constant Factor (0.0481927)

4)

Resigned

It

is a formal act of giving up or quitting one’s office or position.

CAL= Base Pay + Long

Pay x Number of Leave Credits x Constant Factor (0.0481927)

5)

Attrition

It

is the retirement or separation in the police service of PNP Uniformed

Personnel pursuant to any of the means mentioned below (Ref: Sections 24 to 29

of RA No 8551).

a)

Attrition by attainment of maximum tenure in position;

b)

Attrition by relief;

c)

Attrition by demotion in position;

d)

Attrition by non-promotion; and

e)

Attrition by other means.

CAL= Base Pay + Long Pay x Number of Leave Credits x Constant Factor (0.0481927)

Note: If the personnel

reach 20 years of service, Optional will apply

Retirement and

Separation Benefit of Non-Uniformed Personnel of the PNP

Frequently

Asked Questions (FAQs) about PNP Retirement

When do PNP personnel retire?

PNP members must retire from active duty at the age of 56 (compulsory retirement). However, if the officer is a police brigadier general, police major general, or police lieutenant general, the Commission may allow him to stay on for one (1) year.

However,

after twenty (20) years of satisfactory active service (optional retirement), an

officer or non-officer may request and receive retirement benefits from the

Commission.

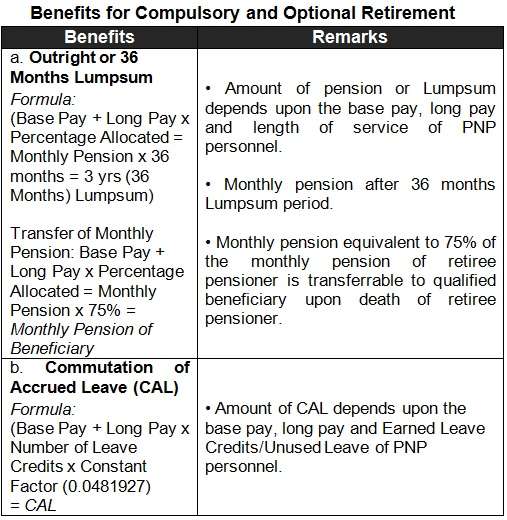

What are the police retirement benefits?

Following a period of active service of twenty (20) years or more, the monthly retirement pay is fifty percent (50%) of the retired grade’s base pay and longevity pay, increasing by two and one-half percent (2.5%) for each year of active service beyond twenty (20), up to a maximum of ninety percent (90%) for thirty-six (36) years or more: Exception: For the first five (5) years, uniformed personnel may elect to receive their retirement pay in advance and in one lump sum. To be paid in full within six (6) months of retirement or completion, provided that: Finally, the PNP officers/non-officers retirement pay will be adjusted based on the active service pay scale.

He is

entitled to one year’s salary and a lifetime pension equal to 80% of his last

salary, plus other benefits as provided by law.

If a

member retired under this section dies within five (5) years of retirement, his

surviving legal spouse, or if none, his surviving dependent legitimate

children, are entitled to the pension for the remainder of the five (5) year

guaranteed period.

Is there another way to retire in PNP?

Officers and non-officers who are permanently and totally disabled as a result of injuries or illnesses contracted in the course of duty, as determined by the appropriate medical officer, shall be separated and considered retired. He is entitled to one year’s salary and a lifetime pension equal to 80% of his last salary, plus other benefits as provided by law.

If a

member retired under this section dies within five (5) years of retirement, his

surviving legal spouse, or if none, his surviving dependent legitimate

children, are entitled to the pension for the remainder of the five (5) year

guaranteed period.

Who is

the surviving spouse?

A

spouse may be considered a survivor for the purposes of derivative pension, or

pension transfer, if:

a.

he/she is legally married to the deceased PNP pensioner prior to the latter’s

retirement/separation;

b. not legally separated by judicial decree issued on grounds attributable to the surviving spouse; and

c. have not abandoned the deceased PNP pensioner without justifiable cause/s.

Who

else may be considered a survivor?

a. The surviving legitimate, legitimated, legally adopted children, including illegitimate children who are unmarried, under the age of majority or over the age of minority but incapacitated and incapable of self-support due to a mental or physical defect acquired prior to the age of majority, who are not married

b. In the absence of a surviving spouse or children, the surviving parent or parents, or in their absence, the surviving unmarried siblings.

Are retiring and retired PNP personnel with pending cases entitled to a pension?

The existence of a pending criminal or administrative case against a retiree does not disqualify payment of PNP retirement benefits.

If the

agency does not terminate or resolve the case within three months of the

retiree’s retirement date, the retiree’s retirement benefits are immediately

released without prejudice to the final resolution of the case. An appeal of

the retiree’s case is a valid reason for withholding PNP retirement benefits.

Which PNP unit is responsible for retired personnel and their beneficiaries?

As a National Support Unit, the PRBS or the PNP Retirement and Benefits Administration Service adjudicates and administers retirement, separation, and death benefits for PNP retirees and their dependents/legal beneficiaries.

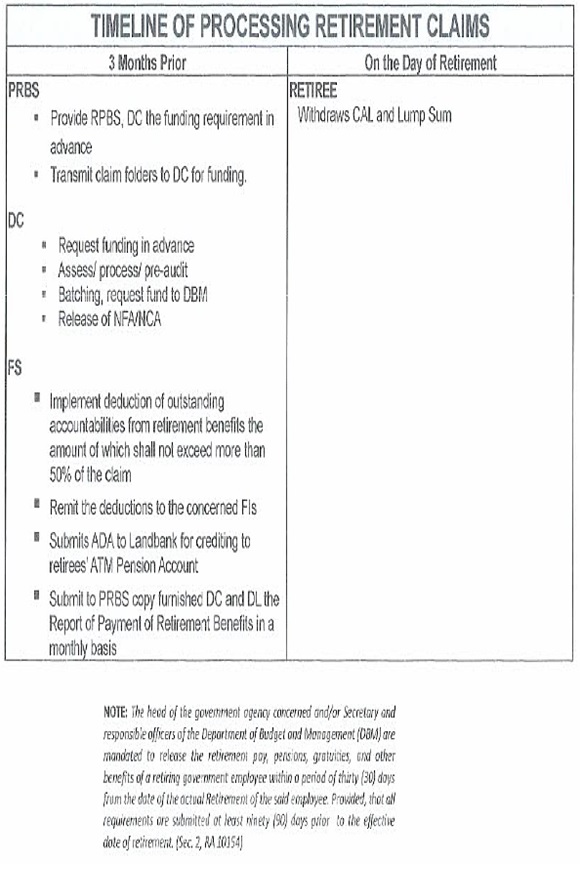

What is the liability of a person who causes an unjustified delay in pension payments?

An erring officer or employee who fails or refuses to release the pension, gratuities, or other retirement benefits due to a retiring government employee within the prescribed time periods may be subject to administrative disciplinary action/s. After a hearing and due process, the erring officer or employee will be suspended without pay for six (6) months to one (1) year, at the discretion of the disciplining authority.

This

penalty does not apply if the release of retirement benefits was prevented by

force majeure or other unavoidable causes. In such cases, the thirty (30) day

period begins when the cause(s) cease to exist.

Sources:

RA 8551

Sec 39 & 40 RA 6975

Section 14 of NAPOLCOM BOR No. 8

Section 37 CSC and MC No. 41 as amended by MC No. 14 Series of 1998)