How to Terminate your PSMBFI membership

How to Terminate your PSMBFI membership

We

frequently see posts on social media about terminating their PSMBFI membership

owing to the recent release of the 2018-2019 Members Experience Refund (MER)

and Members Benefit on Individual Equity Value (MBIEV), which some of its

members were unable to receive (yet).

The

Public Safety Mutual Benefits Fund, Inc. (PSMBFI) is a mutually benefit association

whose objective is to improve the morale and well-being of its members,

especially public safety professionals.

PSMBFI as “insurance” rather than an “incentive.”

Insurance

coverage is crucial for all PNP personnel as it can help them financially in

times of need such as being injured in police operations, killed in action,

accidental death, loan packages, etc.

It is extremely important to the PNP that every member of its workforce is covered by an insurance system that can withstand the risks associated with their line of work.

Historically, all members of the Philippine National Police (PNP) were required to be covered by the Government Service Insurance (GSIS), as the government, as an employer, has an obligation to look after its employees’ well-being.

Congress

passed the GSIS Act of 1997 which exempted the PNP, AFP, BFP, and BJMP uniformed

personnel from GSIS’s mandated social insurance coverage.

However,

the law did not provide an alternative option. Deceased uniformed PNP

personnel’s families lost insurance coverage, and PNP Commanders struggled to

provide financial aid to help bury their fallen comrades.

This

issue prompted former Chief PNP Police Director General Recaredo A. Sarmiento

II to commission an actuarial firm to create a mutual benefit to give insurance

protection to police officers. As a result, the PSMBFI was established.

High-risk

operations and police activities against terrorists or rebels expose uniformed

PNP personnel to a greater need for insurance.

The

Securities and Exchange Commission registered PSMBFI on December 11, 1997, and

the Insurance Commission licensed it on February 4, 1998.

Other

than the PNP, PSMBFI protects the following government agencies: NAPOLCOM, BFP,

PPSC, MMDA, OTS, NAMREA, LTO, PNPA, BI (Immigration), COASTGUARD, and DENR.

The

following insurance plans are offered by PSMBFI:

a. Special Group

Term Insurance (SGTI)

b.

Equity Plan (EP)

c.

Basic Group Term Plan (BGTP)

d. Burial Assistance Benefit (BAB) and

e. Endownment at 56 (E-56)

Every

PSMBFI member pays their monthly premium on the member equity plan.

When

we say premium, it is an agreed price for assuming and carrying the risk – that

is, the consideration paid an insurer (PSMBFI) for undertaking to indemnify the

insured (members) against a specified peril.

In

insurance, there are two parties involved here: the insured and the insurer.

The insured refers to the PSMBFI member or the one who applied for the

insurance policy, while the insurer is the insurance company, which in this

case is the PSMBFI company.

The

uniformed member’s premium is equal to 3% of their monthly basic pay, which is

automatically deducted from their salary.

For

example, if the salary of a patrolman is ₱29,668, his monthly premium for the

member equity plan is ₱890.04. Half of its monthly premium will go to its

savings or equity value and the other half will go to insurance.

The

rank of patrolman has an insurance coverage of ₱438,752.11 for natural death

like sickness. However, if the cause of death is an accident, then the

insurance coverage will be doubled, amounting to ₱877,504.22.

Now,

if God forbid, a patrolman dies in the performance of his duty or in a police

operation, his or her beneficiaries will get a killed-in-action benefit

equivalent to his or her additional 50% of his basic life insurance coverage.

If he/she

is injured or wounded during a major or minor operation, he/she will receive a

wounded-in-action benefit, and if the operation results in permanent

disability, then he/she will get the accident disablement benefit.

If you

have completely decided or opted to terminate your membership with PSMBFI, then

comply with the following requirements:

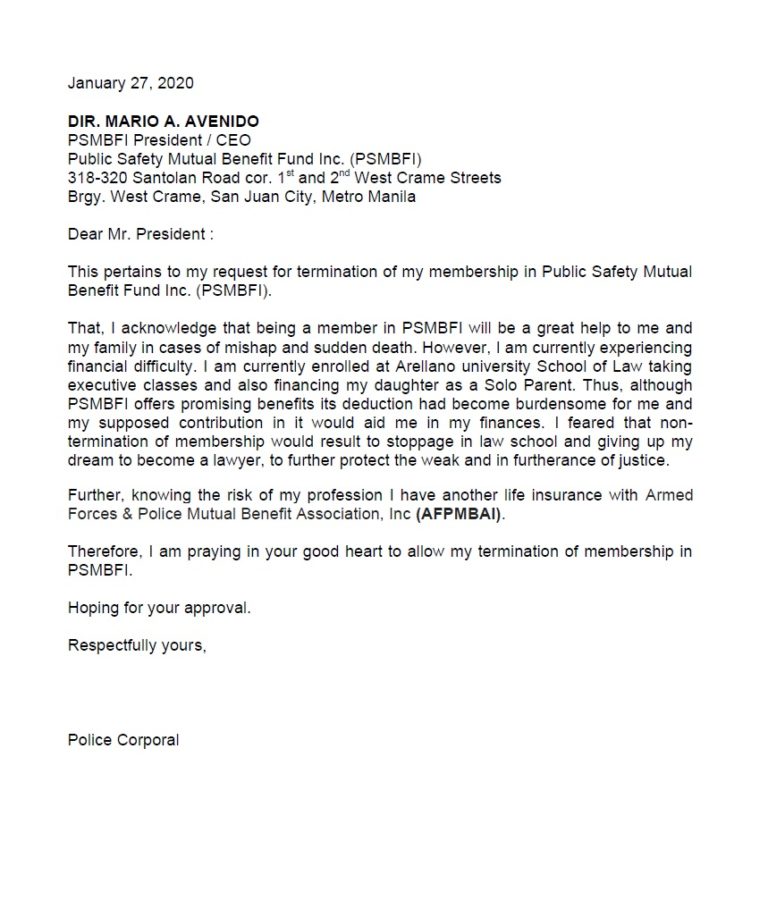

a. Personal

letter of member addressed to PSMBFI President signifying the reason/purpose;

b.

Service record

c. Endorsement

d. Photocopy of PNP ID and latest payslip.

Note: To

know more about the process of terminating your membership, including its

additional requirements, please visit your PSMBFI office near you.

Now

why am I saying these details about insurance to you? Because death is certain

to happen (at some future time).

Life

insurance can assist your family members in repaying whatever debt you leave

behind, including personal and/or educational loans, as well as mortgage debt.

At a

time when your family is already grieving your loss, life insurance can assist

eliminate some of the financial obligations they may face after your death.